API v4 Reference

API Overview

Introduction

This document provides information on how to interact with the Nova Credit API to obtain a Nova Credit Passport®.

The best way to run foreign credit checks using Nova Credit's API is to have your applicants use NovaConnect, an easy-to-use and secure JavaScript module. Visit our Quickstart guide for all details on how to get Nova Credit API credentials and integrate NovaConnect into your app or website today.

Framework and Protocol

The Nova Credit API is organized around REST. It uses resource-oriented URLs, HTTP response codes, and native HTTP functionality such as authentication and verbs. Note that our APIs are served over HTTPS; HTTP is not supported in production.

Delivery Formats

JSON is the default response format except /connect/passport/v4/pdf, which returns a pdf.

Endpoints

Our API host is api.novacredit.com. (See the Quickstart guide for environment information.)

Our resource URL patterns are:

| Endpoint | Description |

|---|---|

GET /connect/accesstoken | Retrieves an access token for an applicant's Nova Credit Passport |

GET /connect/passport/v4/json | Retrieves an applicant's Nova Credit Passport in JSON form |

GET /connect/passport/v4/pdf | Retrieves an applicant's Nova Credit Passport in PDF form |

GET /connect/status | Retrieves the status of an applicant's Nova Credit Passport |

Our /json and /pdf Credit Passport endpoints use versions to support breaking changes and backwards compatibility. The version should be specified as part of the resource URI (e.g.: api.novacredit.com/connect/passport/v4/json).

Older API versions: v3 documentation, v2 documentation, and v1 documentation.

Visit our Quickstart guide to see details on how to call these endpoints with examples.

OpenAPI Specification

Nova Credit Passport® API documentation is also available as an OpenAPI Specification you can download using the link below.

Country Bureau Specifics

See bureau-specific information hereIdentity Data Specifics

Identity Properties by Data Supplier

Each data supplier that Nova Credit works with returns slightly different identity information, which we surface in the Identities node.

Unique Identity Fields

| First Name | Last Name | Full Name | Middle Name | Transliterated Full Name | Other Names | Date of Birth | Emails | Telephones | Is Deceased | Date of Death* | Documents** | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mitek (MITEK) | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ | ✗ | ✗ | ✗ | ✗ | ✓ |

| Australia Equifax (AUS_EFX) | ✓ | ✓ | ✓ | ✓ | ✗ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ | ✗ |

| Canada TransUnion (CAN_TU) | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ |

| Canada Equifax (CAN_EFX) | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✗ | ✓ | ✓ | ✗ |

| Great Britain Equifax (GBR_EFX) | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✓ | ✗ |

| India Crif High Mark (IND_CHM) | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ |

| India CIBIL (IND_CIBIL) | ✗ | ✗ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ |

| Mexico Circulo de Credito (MEX_CDC) | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✓ | ✓ | ✓ | ✗ |

| Mexico Buro de Credito (MEX_BDC) | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ | ✓ | ✗ | ✓ | ✓ | ✗ |

| Korea NICE (KOR_NICE) | ✗ | ✗ | ✓ | ✗ | ✓ | ✗ | ✓ | ✓ | ✗ | ✗ | ✓ | ✗ |

| Nigeria CRC (NGA_CRC) | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✓ | ✗ |

| Brazil Experian (BRA_XP) | ✗ | ✗ | ✓ | ✗ | ✗ | ✓ | ✓ | ✗ | ✓ | ✗ | ✓ | ✗ |

| China Chengxin Credit (CHN_CCX) | ✗ | ✗ | ✓ | ✗ | ✓ | ✗ | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ |

| Kenya Creditinfo (KEN_CI) | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ |

| Dominican Republic TransUnion (DOM_TU) | ✓ | ✓ | ✓ | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ |

| Philippines CRIF (PHL_CRIF) | ✓ | ✓ | ✓ | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✗ | ✓ | ✓ |

| Spain Equifax(ESP_EFX) | ✗ | ✗ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ |

| Austria CRIF (AUT_CRIF) | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ |

| Germany CRIF (DEU_CRIF) | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ |

| Switzerland CRIF (CHE_CRIF) | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ |

| Philippines TU (PHL_TU) | ✓ | ✓ | ✓ | ✓ | ✗ | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ |

| United States Experian (USA_XP) | ✓ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ | ✓ | ✓ | ✗ | ✗ | ✓ |

| Ukraine Creditinfo (UKR_CI) | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ | ✓ | ✓ | ✗ | ✗ | ✗ | ✗ |

| South Africa TransUnion (ZAF_TU) | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✗ | ✗ |

| Ghana XDS Data (GHA_XDS) | ✓ | ✓ | ✓ | ✗ | ✗ | ✗ | ✓ | ✓ | ✗ | ✗ | ✗ | ✗ |

| Colombia TransUnion (COL_TU) | ✗ | ✗ | ✓ | ✗ | ✗ | ✓ | ✗ | ✗ | ✗ | ✗ | ✗ | ✗ |

*Only provided if Is Deceased is true

**Where available, we provide the information extracted from ID documents submitted by the consumer

Sandbox Mode

Sandbox Users for Credit Bureau Inputs by Country

Nova provides integrating clients with a number of test users that they can submit data for in order to analyze a response. By default, the information for only one user is present alongside NovaConnect when in the sandbox environment although the following user information may be submitted.

In general, the "Default User" for each bureau has a low risk profile and clean credit history.

Australia Equifax (AUS_EFX)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Samantha | Charlotte | Noah |

| Last name | O'Connor | Williams | Taylor |

| Date of birth | 03-30-1991 | 07-01-1991 | 09-20-1960 |

| Email address | samantha@email.com | charlotte@email.com | noah@email.com |

| Gender | Female | Female | Male |

| Street address | 10 Seahorse Court | Main Drive | 24 Kingsland Road |

| Suburb | Indented Head | Werribee South | Berala |

| State | Victoria | Victoria | New South Wales |

| Postcode | 3223 | 3030 | 2141 |

| Australian Driver's License state of issue | New South Wales | Victoria | Victoria |

| Australian Driver's License number | 98056840 | 85989564 | 85544842 |

| Australian Driver's License card number | F1234567 | 098ABC | 123XYZ |

| Australian Passport number | PA0000128 | C5100511 | |

| Australian Medicare Card number | 2951709671 | 2951777281 | |

| Australian Medicare Card reference number | 1 | 1 | |

| Australian Medicare Card valid to date | 04-2051 | 05-2051 | |

| Australian Medicare Card color | Green | Green | |

| Australian Medicare Card middle name | E | none | |

| Australian Immigration Card number | ABC123456 | ||

| Australian Immigration Card birth month | March | ||

| Australian Immigration Card birth year | 1991 | ||

| International Passport issuing country | Canada | ||

| International Passport Number | AA123456 |

Canada TransUnion (CAN_TU)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Olivia | Fernando | John |

| Last name | Tremblay | Isabell | Fence |

| olivia@email.com | fernando@email.com | john@email.com | |

| Date of birth | 04-25-1973 | 05-04-1955 | 10-11-1960 |

| SIN | 734779572 | ||

| Address | 33 Cork St W | 170 Jackson Street West | 100 Main Street West |

| City | Guelph | Hamilton | Hamilton |

| Province | Ontario (ON) | Ontario (ON) | Ontario (ON) |

| Postal code | N1H 2W9 | L8P 1L9 | L8P 1H6 |

| Question 1/3 | 675 UPPER JAMES ST | BANK OF MONTREAL | ONTARIO |

| Question 2/3 | CAR LOANS CANADA | NONE OF THE ABOVE | 408 SCOOBY RD |

| Question 3/3 | THE BAY CREDIT CARD | 208 EMBARCADERO S | MAIN STREET WEST |

Canada Equifax (CAN_EFX)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Emma | Chris | Allen |

| Last name | Smith | Jerrold | Mikey |

| emma@email.com | chris@email.com | allen@email.com | |

| Date of birth | 10-25-1989 | 01-11-1954 | 12-16-1967 |

| SIN | 111222333 | 111220231 | |

| Address | 1966 Eglinton Avenue East | 2320 16 Avenue Northwest | 10520 111 Avenue Northwest |

| City | Toronto | Calgary | Edmonton |

| Province | Ontario (ON) | Alberta (AB) | Alberta (AB) |

| Postal code | M1L 2M6 | T2N 4H8 | T5G 0B6 |

| Question 1/3 | None of the above | Chartwell Road | HSBC |

| Question 2/3 | None of the above | NSLSC | 2014 |

| Question 3/3 | 2333 | 0231 | 8888 |

Credit Reference Center of the People's Bank of China (CHN_CCRC) - In development

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| Name | 美丽 | 上官云开 | 立修 |

| mei@email.com | shangguan@email.com | zhou@email.com | |

| Date of birth | 09-25-1989 | 01-02-1990 | 09-13-1988 |

| CCRC report | Download file | Download file | Download file |

China Chengxin Credit (CHN_CCX)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| Chinese name | 张三 | 徽因 | 望舒 |

| Chinese resident ID | 123456199001011233 | 110101198001236685 | 110101199001017559 |

| zhangsan@email.com | huiyin@email.com | wangshu@email.com | |

| Chinese mobile number | 13800138000 | 13800138000 | 13800138000 |

Great Britain Equifax (GBR_EFX)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | David | Nathan | Allie |

| Last name | Jones | Smith | Gretchen |

| david@email.com | nathan@email.com | allie@email.com | |

| Date of birth | 10-25-1989 | 01-04-1988 | 12-30-1987 |

| Street address | 177 Brompton Road | 11 Granby Road | 4 Aaron Road |

| Post town | London | Bournemouth | Cirencester |

| Post code | SW31NF | BH9 3NZ | GL7 6JD |

| Question 1/3 (mobile phone/cable/credit card) | Vodafone | None of the above | Barclays |

| Question 2/3 (current account opened/credit limit) | Barclays | £ 2000 - £ 2500 | None of the above |

| Question 3/3 (overdraft limit) | £ 2500 to £ 2999 | £ 2500 to £ 2999 | £ 50 - £ 100 |

India Crif High Mark (IND_CHM)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Raj | Diya | Sona |

| Last name | Du | Puja | Arati |

| Date of birth | 10-25-1989 | 02-06-1976 | 10-11-1966 |

| Father's last name | Du | Puja | Arati |

| Email address | rajdu@email.com | diya@email.com | sona@email.com |

| Indian phone number | 6233334444 | 7234567892 | 8580066232 |

| Street address | 2 Community Center | 55 Park Street | 1 Juhu Tara Road |

| City | New Delhi | Kolkata | Mumbai |

| State | Delhi (DL) | West Bengal (WB) | Maharashtra (MH) |

| Pincode | 110017 | 700017 | 400049 |

| PAN number | ADIPA8123J | AFUPJ7365N | AAWPH3050M |

| Voter ID number | AB953789734322 | CC6849897356234 | NMA34121422221 |

| Question 1 | RBL Bank | None of the above | 36,000 |

| Question 2 | New Delhi | ICICI Bank | Yes Bank |

| Question 3 | 2005 | 7 | 2 |

India TransUnion CIBIL (IND_CIBIL)

Please note that if the correct security code is entered, other security questions will not be asked.

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Anik | Astha Sai | Vijay |

| Last name | Shah | Dutta | Pratap Krish |

| Date of birth | 11-26-1992 | 01-28-1986 | 01-13-1995 |

| Gender | Male | Female | Male |

| Email address | anik@email.com | astha@email.com | vijay@email.com |

| Indian phone number | 9773949726 | 9775550000 | 9779991234 |

| Street address | 2 3218 STREET NO 2 BALBIR NAGARSHAHDRA | 1 Daresi Rd, Sheb Bazar, Rakabganj | 101, MI Road, Bapu Bazar, Biseswarji |

| City | Delhi | Agra | Jaipur |

| State | Delhi (DL) | Uttar Pradesh (UP) | Rajasthan (RJ) |

| Pincode | 110009 | 282003 | 302001 |

| PAN number | YEHPG0098E | ABCPD0000A | XYZPK2020K |

| Passport number | A1234567 | A00001234 | A12341234 |

| Security code | 092090 | 925925 | 561678 |

| Question 1 | Scb | Sbi Card | None of the Above |

| Question 2 | 1500001 | 17000 | I Don't Have An Account With Icici Bank |

| Question 3 | 147000 | 30000 | 25000 |

| Question 4 | Pnb Hsg | Rbl Bank | Axis Bank |

| Question 5 | Bajaj Fin Ltd | Icici Bank | Axis Bank |

India Universal (works for both IND_CIBIL and IND_CHM)

Please note the following:

- If the correct security code is entered, other security questions will not be asked.

- A report has not yet been finalized for this user, though the user is available to test NovaConnect and the Connect API

| Inputs | Default (Low Risk) User |

|---|---|

| First name | Ishaan |

| Last name | Mohan |

| Father's Last Name | Mohan |

| Date of birth | 11-26-1992 |

| Gender | Male |

| Email address | ishaan@email.com |

| Indian phone number | 9773949726 |

| Street address | 2 3218 STREET NO 2 BALBIR NAGARSHAHDRA |

| City | Delhi |

| State | Delhi (DL) |

| Pincode | 110009 |

| PAN number | YEHPG0098E |

| Passport number | A1234567 |

| Security code | 092090 |

| Question 1 (CIBIL) | Scb |

| Question 2 (CIBIL) | 1500001 |

| Question 3 (CIBIL) | 147000 |

| Question 4 (CIBIL) | Pnb Hsg |

| Question 5 (CIBIL) | Bajaj Fin Ltd |

| Question 1 (CHM) | RBL Bank |

| Question 2 (CHM) | New Delhi |

| Question 3 (CHM) | 2005 |

Mexico Universal (works for both MEX_BDC and MEX_CDC)

Please note the following:

- In order to trigger a cascade with the universal user, enter an incorrect

Father's last namefor the user below for the first try (MEX_BDC). When NovaConnect cascades to MEX_CDC, enter the correctFather's last namealong with the correspondingFirst name(s)value.

| Inputs | Default (Low Risk) User |

|---|---|

| First name (MEX_BDC) | Lara |

| Second name (MEX_BDC) | del Rosario |

| First name(s) (MEX_CDC) | Lara del Rosario |

| Father's last name | Ortega |

| Mother's last name | Fuentes |

| Date of birth | 05-06-1992 |

| Email address | lara@email.com |

| Street name and number | Jaime Balmes #8 |

| City | Ciudad de México |

| District/Town | Los Morales Polanco |

| Zipcode | 11510 |

| State | Ciudad de México (CDMX) |

| Do you have an active mortgage in Mexico? | Yes |

| Have you had an auto loan in the last 2 years in Mexico? | No |

| Do you have an active credit card in Mexico? | Yes |

| Provide the last 4 digits of any of your Mexican credit cards | 1234 |

Mexico Circulo de Credito (MEX_CDC)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Juan | Xavier | Alexis |

| Father's last name | Garcia | Jose | Elena |

| Mother's last name | Gonzales | Barrios | Quipa |

| Date of birth | 10-25-1989 | 12-12-1972 | 06-03-1982 |

| Email address | juan@email.com | xavier@email.com | alexis@email.com |

| Street name and number | 357 Avenida Insurgentes Sur | 2 Calle James Sullivan | 1 Miguel Laurent |

| City | Ciudad de México | Ciudad de México | Ciudad de México |

| Zipcode | 06100 | 06470 | 03200 |

| State | Ciudad de México (CDMX) | Ciudad de México (CDMX) | Ciudad de México (CDMX) |

| Do you have an active mortgage in Mexico? | No | No | Yes |

| Have you had an auto loan in the last 2 years in Mexico? | Yes | Yes | No |

| Do you have an active credit card in Mexico? | Yes | Yes | No |

| Provide the last 4 digits of any of your Mexican credit cards | 0000 | 4827 |

Mexico Buro de Credito (MEX_BDC)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Lara | Alejandra | Mitzi |

| Second name | del Rosario | Maria | Manuela |

| Father's last name | Ortega | Hernández | Martínez |

| Mother's last name | Fuentes | García | Márquez |

| Date of birth | 05-06-1992 | 11-06-1992 | 10-26-1999 |

| Email address | lara@email.com | alejandra@email.com | mitzi@email.com |

| Street name and number | Jaime Balmes #8 | Calle Ozuluama 4 | Av. Benjamín Franklin 45 |

| City | Ciudad de México | Ciudad de México | Ciudad de México |

| District/Town | Los Morales Polanco | Hipódromo | Colonia Condesa |

| Zipcode | 11510 | 06100 | 06140 |

| State | Ciudad de México (CDMX) | Ciudad de México (CDMX) | Ciudad de México (CDMX) |

| Do you have an active mortgage in Mexico? | Yes | Yes | No |

| Have you had an auto loan in the last 2 years in Mexico? | No | No | No |

| Do you have an active credit card in Mexico? | Yes | Yes | No |

| Provide the last 4 digits of any of your Mexican credit cards | 1234 | 1910 |

Korea NICE (KOR_NICE)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| Full name | 이지훈 | 신은선 | 박수진 |

| Date of birth | 10-20-1975 | 11-01-1990 | 05-30-1994 |

| jihoon@email.com | eunsun@email.com | soojin@email.com | |

| Gender | Male | Female | Female |

| Phone number | +1 (415) 555-5555 | +1 (408) 590-4123 | +1 (420) 143-1738 |

Nigeria CRC (NGA_CRC)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| Full name | Daraja Attah | Aminu Ojo Oni | Sunkanmi Oyekan |

| Bank verification number | 83920323750 | 22237445315 | 43098094389 |

| Date of birth | 01-15-1985 | 04-13-1977 | 09-22-1968 |

| Gender | Female | Male | Male |

| Email address | daraja@email.com | aminu@email.com | sunkanmi@email.com |

Brazil Experian (BRA_XP)

| Inputs | Default (Low Risk) User |

|---|---|

| First name | Ana |

| Last name | Silva |

| Date of birth | 03-25-1980 |

| CPF number | 170.719.241-39 |

| Email address | ana@email.com |

Kenya Creditinfo (KEN_CI)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Wangechi | Naliaka | Vincent |

| Last name | Mwangi | Makani | Abong'o |

| Date of birth | 05-05-1980 | 01-27-1988 | 04-20-1994 |

| National ID | 40133214 | 30581375 | 31665491 |

| Email address | wangechi@email.com | naliaka@email.com | vincent@email.com |

| Name of the financial institution where you took your last non-mobile loan | Kenya Commercial Bank Ltd | Chase Bank (K) Ltd. | Standard Chartered Bank Kenya |

| When did you take out your last non-mobile loan? | 2016-08 | 2016-07 | 2016-08 |

| Have you ever taken a mobile loan? | Yes | Yes | Yes |

| Which of these is the last four digits of a past or current Kenyan mobile phone number? | 6006 | 3737 | 2550 |

Dominican Republic TransUnion (DOM_TU)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| Full name | Jean Carlos Rodriguez Garcia | Juana Mercedes Toribio Reyes | Maria Jose Maderas Troncoso |

| Date of birth | 08-06-1993 | 04-18-1963 | 09-22-1981 |

| National ID | 11700074831 | 00200106557 | 00200994465 |

| Email address | jean@email.com | juana@email.com | maria@email.com |

| Question 1 | None of the above | None of the above | None of the above |

| Question 2 | None of the above | None of the above | 1 |

| Question 3 | 1 | 3 | 1 |

| Question 4 | No | Yes | Yes |

| Question 5 | None of the above | None of the above | EMIGK |

ASNEF-Equifax, S.L., and Equifax Ibérica, S.L. Spain (ESP_EFX)

| Inputs | Default (Low Risk) User |

|---|---|

| First name | Carlos Antonio |

| Last name | Fernández Soto |

| Date of birth | 03-25-1962 |

| Gender | Male |

| Email address | carlos@email.com |

| DNI Number | 99999999R |

| Passport Number | 9999999999999 |

CRIF GmbH Austria (AUT_CRIF)

| Inputs | Default (Low Risk) User |

|---|---|

| First name | Sonja |

| Last name | Baliko |

| Date of birth | 07-15-1968 |

| Gender | Female |

| Email address | sonja@email.com |

| Street | Erdberger Lände 12 |

| City | Wien |

| Postcode | 1030 |

| Country | Austria |

CRIF AG Switzerland (CHE_CRIF)

| Inputs | Default (Low Risk) User |

|---|---|

| First name | Patrick |

| Last name | Herrman |

| Date of birth | 04-04-1975 |

| Gender | Male |

| Email address | patrick@email.com |

| Street | Riva Giocondo Albertolli 1 |

| City | Lugano |

| Postcode | 6900 |

| Country | Switzerland |

CRIF Bürgel GmbH Germany (DEU_CRIF)

| Inputs | Default (Low Risk) User |

|---|---|

| First name | Gabriele |

| Last name | Moench |

| Date of birth | 07-07-1989 |

| Gender | Female |

| Email address | gabriele@email.com |

| Street | Sandstraße 3A |

| City | Nürnberg |

| Postcode | 90443 |

| Country | Germany |

Philippines Universal (works for both PHL_CRIF and PHL_TU)

| Inputs | Default (Low Risk) User |

|---|---|

| First name | Miguel |

| Middle name | |

| Last name | Reyes |

| Date of birth | 07-31-1997 |

| Gender | Male |

| Email address | miguel@email.com |

| Street address | 2399 Taft Ave |

| Barangay | |

| Subdivision | Malate |

| City / Municipality | Manila |

| Province | Metro Manila |

| Post code | 1004 |

| Phone Number | 9876543210 |

| TIN (Taxpayer Indentification Number) | 3312995553 |

| SSS (Social Security System) Number | 9877678799 |

| GSIS (Government Service Insurance System) Number | 65656512302 |

Philippines CRIF (PHL_CRIF)

| Inputs | Default (Low Risk) User |

|---|---|

| First name | Carla Rose |

| Middle name | |

| Last name | Osmena |

| Date of birth | 11-27-1990 |

| Gender | Female |

| Email address | carlarose@email.com |

| Street address | No 9006 RMS Apt Unit B St Mary St Maxima |

| Barangay | |

| Subdivision | Palico 2 |

| City / Municipality | Imus |

| Province | Cavite |

| Post code | |

| TIN (Taxpayer Indentification Number) | 878765576 |

| SSS (Social Security System) Number | 9639948488 |

| GSIS (Government Service Insurance System) Number | 77749345432 |

Philippines TU (PHL_TU)

| Inputs | Default (Low Risk) User |

|---|---|

| First name | Miguel |

| Middle name | |

| Last name | Reyes |

| Date of birth | 07-31-1997 |

| Gender | Male |

| Email address | miguel@email.com |

| Street address | 2399 Taft Ave |

| Barangay | |

| Subdivision | Malate |

| City / Municipality | Manila |

| Province | Metro Manila |

| Post code | 1004 |

| Phone Number | 9876543210 |

| TIN (Taxpayer Indentification Number) | 3312995553 |

| SSS (Social Security System) Number | 9877678799 |

| GSIS (Government Service Insurance System) Number | 65656512302 |

Ukraine Creditinfo (UKR_CI)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Ivan | Lyubov | Olena |

| Last name | Ivanov | Shevchenko | Melnyk |

| Date of birth | 10-15-1985 | 08-23-1973 | 02-01-1990 |

| Email address | ivan@email.com | lyubov@email.com | olena@email.com |

| Passport Number | CA123456 | MN285039 | DB223456 |

| TIN (Taxpayer Indentification Number) | 1234567890 | 4144217209 | 0451799112 |

| ID (Identity Card) Number | 123456789 | 990127761 |

Experian USA (USA_XP)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Tina | Brian | Katherine |

| Middle name | W | ||

| Last name | Smith | Blakely | Maxim |

| Date of birth | 07-08-1937 | 02-08-1967 | 11-01-1975 |

| Email address | tina@email.com | brian@email.com | katherine@email.com |

| SSN | 520047745 | 666416169 | 666412692 |

| Street address | 522 County Road 871 | 1077 S Hayworth Ave | 20 Garfield Ave |

| City | Crane Hill | Los Angeles | Danvers |

| State | Alabama | California | Massachusetts |

| Postal code | 35053 | 90035 | 01923 |

South Africa TransUnion (ZAF_TU)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First name | Thabo | Onalerona | Anika |

| Last name | Khoza | Dlamini | Ackerman |

| Date of birth | 10-25-1989 | 07-08-1987 | 06-11-1977 |

| Email address | thabo@email.com | onalerona@email.com | anika@email.com |

| Id Number | 9101010000000 | 8908070570185 | 4706113622185 |

| Id Type | SAID | Passport | SAID |

| Which full title Property did you purchase first (oldest) | NO 2 ENNISKILLEN, SPRINGFIELD, KWAZULU NATAL | same as Thabo | same as Thabo |

| Which credit provider do you have a joint loan account with | FNB PRIVATE CLIENTS HOME | same as Thabo | same as Thabo |

| Which of the following accounts have been paid up in the last 12 months | C) IDENTITY | same as Thabo | same as Thabo |

| Which of the following credit providers do you have active account/s with | A) FNB PRIVATE CLIENTS HOME | same as Thabo | same as Thabo |

| When did you resign as a principal from the following company: E AND C HARRY HOLDINGS | NONE OF THE ABOVE | same as Thabo | same as Thabo |

| When did you take a loan against your policy with NEDBANK GROUP BROKERS | NONE OF THE ABOVE | same as Thabo | same as Thabo |

Ghana XDS (GHA_XDS) - In development

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| Full name | Ashanti Kanor | Najilan Mawusi | Ohene Edusei |

| Date of birth | 10-25-1989 | 04-12-1973 | 12-24-1998 |

| Document type | National Id | National Id | Passport |

| Document number | GHA0123456789 | GHA8492739473 | 8842701234 |

| Email address | ashanti@email.com | najilan@email.com | ohene@email.com |

Colombia TransUnion (COL_TU)

| Inputs | Default (Low Risk) User | Medium Risk | High Risk |

|---|---|---|---|

| First Name | Celia | Sofia | Jhon |

| Last Name | Gallegos | Alvarez | Rojas |

| Date of birth | 10-25-1989 | 03-17-1963 | 06-05-1991 |

| Most Recent Phone | 3205368030 | 3436289931 | 3505432684 |

| Document Type | Citizenship Card | Citizenship Card | Citizenship Card |

| Document Number | 12343542 | 9384794 | 23455432 |

| Document Issue Date | 03-22-2013 | 07-15-2001 | 08-20-2018 |

| Email Address | celia@email.com | sofia@email.com | jhon@email.com |

| Security Code | 1234 | 1234 | 1234 |

| Question 1 | Ninguna de las anteriores | Ninguna de las anteriores | Ninguna de las anteriores |

| Question 2 | CUENTA CORRIENTE Y TARJETA DE CREDITO | CUENTA CORRIENTE Y TARJETA DE CREDITO | CUENTA CORRIENTE Y TARJETA DE CREDITO |

| Question 3 | DANN REGIONAL S.A. | DANN REGIONAL S.A. | DANN REGIONAL S.A. |

Stripe Sandbox Values

If you have applicant payments enabled for your account, you may use the following fake credit card numbers to test the applicant's end-to-end Nova application, including simulations of an applicant's payment for their Nova Credit Passport.

Please note that this feature is only available for select customers. Contact your Nova Credit Representative to learn more.

| Description | Card Number | Name on Card | Expiration Date | CVC |

|---|---|---|---|---|

| Successful Payment (credit card) | 4242424242424242 | Anything | Anything in the future | Anything |

| Unsuccessful Payment (credit card decline) | 4242424242424000 | Anything | Anything in the future | Anything |

Simulating Different Cases in the Credit Bureau Flow in NovaConnect

When using NovaConnect in sandbox mode, you may input one of the following values in the Last Name field (in some country forms, the Father's last name or Full name field) to more conveniently simulate different cases:

| Inputs | Description |

|---|---|

expiresoon | Simulates the EXPIRED status after 5 minutes instead of 72 hours (triggred by prefill.lastName only) |

bureaudown | Simulates the error shown when a bureau is offline or unresponsive |

error | Simulates generic NovaConnect error |

timeout | Simulates the countdown shown to an applicant who has failed their first attempt and not completed a second |

KYC Sandbox Simulation

If you have KYC enabled for your account, you may use our built-in KYC sandbox to test an applicant's journey through our verification flow.

The sandbox will, by default, simulate a successfully authenticated passport for a sandbox user from the selected country. Please contact us if you need other sandbox simulations for the verification flow.

Please note that you should have a mobile device nearby in order to take a photo of the document to be verified.

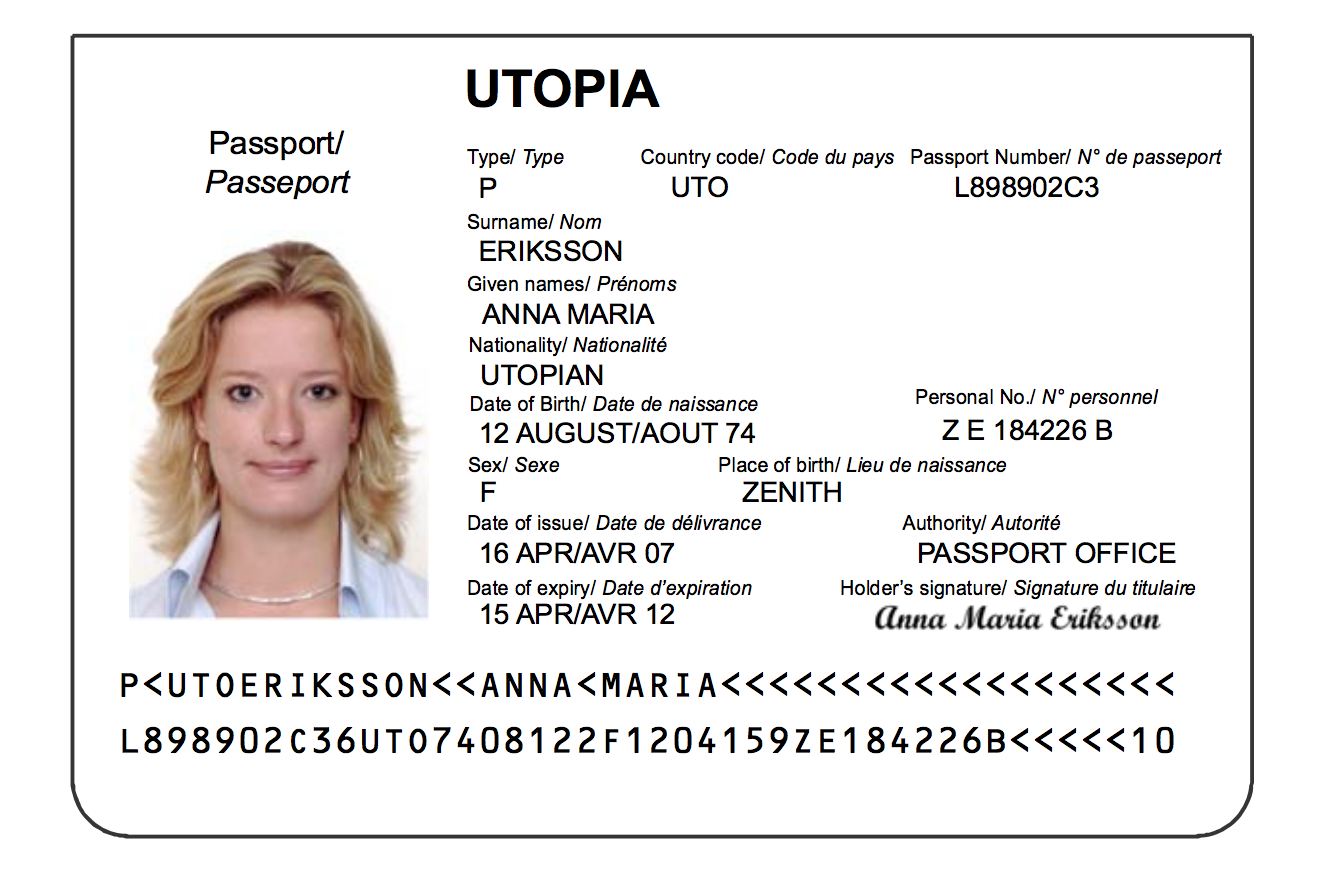

When prompted, take a photo of a real passport or the sample passport below (ICAO9303 specimen):

Document capture allowed retries

On the document capture screen in NovaConnect, users have the ability to retry document submission up to three times for each individual document (e.g. passport, and selfie).

In the event that the maximum number of retries is reached, NovaConnect will prevent the user from submitting any additional documents and instead display a screen indicating that the flow has been completed.

Data Types & Formats

Data Types

| Type | Description |

|---|---|

| String | Extended character set, numbers and punctuation symbols. This includes non-ASCII language-specific characters such as ß, à, ç, é, and more (all encoded as utf8). |

| Integer | A rounded numerical value. |

| Number | A 64-bit floating decimal point format which could include 64-bit integers (decimal floating to include 0 decimal places). |

| Bool | A boolean-flag indicating true or false. |

| Object | Nested JSON level with more field-values. |

| Array | A value or type array contains a zero or positive amount of elements. The elements can be of any type. |

| Null | The reserved value null. May be combined with other types as in Bool or Null |

Data Formats

| Format | Description |

|---|---|

| Timestamp | (String) UTC ISO 8601 data and time format. Full specs according to RFC 3339. Example: 1982-09-26T32:20:50.52Z |

| Full Date | (String) UTC ISO 8601 date format. Full date format in YYYY-MM-DD. Example: 1982-09-26 |

| Short Date | (String) UTC ISO 8601 date format. Shorter format in YYYY-MM. Example: 1982-09 |

| UUID | (String) Universally Unique Identifier according to RFC 4122 |

| URI | (String) Uniform Resource Identifier according to RFC 3986 |

| Short Version | (String) Version number is predicated with "V" e.g. "V1", "V2", "V3", or "V4". Case insensitive. |

| Full Version | (String) Semantic versioning. http://semver.org/ |

| Percentage | (Float, 2 decimal) Formatted in the range of 0 - 100% excluding percentage symbol |

| Pipe | (String) Pipe-delimited string of values. E.g. val1 (Pipe) val2 (Pipe) val3 |

| ISO 3166-1 alpha-3 | (String) Three letter country codes. E.g. CAN, MEX, IND |

| ISO 4217 | (String) Three letter currency code. E.g. USD, EUR, INR |

Credit Passport® Structure

Example of the JSON structure of the Nova Credit Passport® response:

{

"meta": {

...

},

"product": {

...

},

"sources": [

...

],

"scores": [

...

],

"metrics": [

...

],

"currencies": [

...

],

"personal": {

...

},

"identities": [

...

],

"credit_bureaus": [

...

]

}

The Nova Credit Passport® response body is segmented into four objects and five arrays. The structure is as follows:

meta{object}product{object}sources{object}personal{object}identities[array]scores[array]metrics[array]currencies[array]credit_bureaus[array]

Data sourced from credit bureaus will be provided in credit_bureaus, including tradelines, addresses, and currencies.

In addition to the above elements, certain countries provide applicant data that others don't. In the documentation below, you will find corresponding tables that show which bureaus that support each of these nodes:

inquiries[array]public_records[array]frauds[array]collections[array]nonsufficient_funds[array]bank_accounts[array]employers[array]disputes[array]notices[array]

Credit Passport® Body

Consistently Returned Fields (*)

Due to the API consolidating many different data sources, most fields in the response are optional.

Fields marked with a * are always returned. If a field is marked with a * but its parent is not (for example, scores.adverse_action_codes and scores.adverse_action_codes.code*), it is always returned given that its parent is returned. It will not be present if its parent is not present.

meta

Example snippet of meta in the Credit Passport response:

{

"meta": {

"public_token": "ff0886a4-f3ff-11e6-bc64-92361f002671",

"pdf_name": "raj_du_92361f002671.pdf",

"external_id": "d20f8cb2-969a-4448-97ea-c0680ed4d880",

"user_args": "235234224",

"created_at": "2017-01-13T11:07:46.51Z",

"country_destination": "USA",

"api_version": "4.6.85",

"consent_version": "1.4.73",

"public_id": "7d0772419d3e0ec635af1936fc19607401002fe22d9e843ac1399aca482ca40a",

},

...

}

Information specific to the report that's been returned.

| Field | Format | Notes |

|---|---|---|

public_token* | UUID | The unique identifier of this report |

pdf_name* | String | File name of the associated PDF report |

created_at* | Timestamp | The date the credit report was retrieved |

country_destination* | ISO 3166-1 alpha-3 | Destination country, the country the creditor operates in country |

api_version* | Full version | The API version used to generate this report |

consent_version* | Full version | The consent version the applicant agreed to |

public_id* | String | The unique identifier for your account used when pulling this report |

external_id | String | The unique identifier of the report, this is defined by the institution pulling this report |

user_args | String | The input of the userArgs function in NovaConnect |

consumer_notices []

Example snippet of consumer_notices in the Credit Passport response:

{

"consumer_notices": [

{

"consumer_notice_id": "9d749b19-f1e9-46e6-9f68-b03b1d476f16",

"description": "Tradeline 2 from Example Bank Ltd. is no longer open.",

"confirmed_at": "2023-10-12T18:28:30.000Z",

},

...

],

}

Correction notices from consumers regarding the information in the report. Note that this section is only available for customers based in the UK or Canada, and will show up on UK PDF reports as "Notice of Correction" and Canadian PDF reports as "Consumer Statement".

| Field | Format | Notes |

|---|---|---|

consumer_notice_id* | UUID | The unique identifier of this notice |

description* | String | The correctional information for the report |

confirmed_at* | Timestamp | Proof of confirmation from the consumer |

product

Example snippet of product in the Credit Passport response:

{

"product": {

"name": "Village Communities",

"product_id": "9cf178e0-760e-11e7-abf3-5da9d338ae4b",

"inquiry_type": "TENANT"

},

...

}

Details of the product the applicant applied for. Please refer to the Product reference in the Quickstart Guide.

| Field | Format | Notes |

|---|---|---|

name* | String | Product name as specified in Nova Credit Dashboard |

product_id* | UUID | Product ID |

inquiry_type* | String | Inquiry type of the product. See product inquiry_type values |

sources []

Example snippet of sources in the Credit Passport response:

{

"sources": [{

"source_id": "IND_CHM",

"country": "IND",

"source_type": "CREDIT_BUREAU",

"status": "SUCCESS",

"attempts": 3,

"partner_report_id": "8bae67dc-3eda-5a77-b910-002g79b184ed",

}],

...

}

A list of data sources used to build the applicant's Credit Passport®.

| Field | Format | Notes |

|---|---|---|

source_id* | String | A human-readable identifier for the source, unique within the context of the Credit Passport® |

source_type* | String | The type of source the data was sourced from. See source_types |

status* | String | The final status for the source. See status |

attempts* | Number | The number of attempts to utilize the source before reaching a final status. Minimum of 1 |

country | ISO 3166-1 alpha-3 | The code for the country the data was sourced from. See country |

partner_report_id | String | The unique report identifier for the partner provided report or data |

personal

Example snippet of personal in the Credit Passport response:

{

"personal": {

"match_algorithm": "NOVA_MATCH_BETA",

"first_name": {

"value": "Raj",

"source_ids": ["IND_CHM"],

"unmatched_source_ids": [],

},

"last_name": {

"value": "Du",

"source_ids": ["IND_CHM"],

"unmatched_source_ids": [],

},

"full_name": {

"value": "Raj Du",

"source_ids": ["IND_CHM"],

"unmatched_source_ids": [],

},

"emails": [

{

"value": "rajdu@email.com",

"source_ids": ["IND_CHM"],

},

],

"telephones": [

{

"value": "+9146270422",

"source_ids": ["IND_CHM"],

},

],

"date_of_birth": {

"value": "1989-10-25",

"source_ids": ["IND_CHM"],

"unmatched_source_ids": [],

},

"is_deceased": {

"value": false,

"source_ids": ["IND_CHM"],

"unmatched_source_ids": [],

},

"foreign_id": {

"value": "ADIPA8123J",

"source_ids": ["IND_CHM"],

"unmatched_source_ids": [],

},

"foreign_id_type": {

"value": "PERMANENT_ACCOUNT_NUMBER",

"source_ids": ["IND_CHM"],

"unmatched_source_ids": [],

}

},

...

}

Personal information specific to the applicant whose credit report is being accessed. Information is stored wrapped in the PersonalField format, which indicates where each value was sourced from.

| Field | Format | Notes |

|---|---|---|

match_algorithm* | String | The algorithm used to determine whether provided values are considered to be a match. See match_algorithm |

first_name | PersonalField object with String value | Applicant's first name |

last_name | PersonalField object with String value | Applicant's last name |

full_name* | PersonalField object with String value | Applicant's full name |

middle_name | PersonalField object with String value | Applicant's middle name |

transliterated_full_name | PersonalField object with String value | Romanization of applicant's full name |

other_names | Array of PersonalField objects with String value | The string value is another name associated with the applicant, such as an alias, maiden name, or other surname |

emails | Array of PersonalField objects with String value | Applicant's emails |

telephones | Array of PersonalField objects with String value | Applicant's telephones |

date_of_birth | PersonalField object with Full Date value | Applicant's date of birth |

year_of_birth | PersonalField object with String value | Only provided if a full date of birth is not available, but the year is. date_of_birth will be omitted in this case |

is_deceased* | PersonalField object with Bool value | Indicates whether the applicant is deceased. This can only return true for CAN_EFX, MEX_BDC, and MEX_CDC. |

date_of_death | PersonalField object with Full Date or Short Date value | The date of death for the applicant. Only provided if is_deceased is true |

foreign_id | PersonalField object with String value | The foreign ID provided to us by the consumer. Note that this field may not always be present. |

foreign_id_type | PersonalField object with String value | The type of ID being displayed in capital snake case. In the PDF this field will appear in plain text (e.g., Permanent Account Number (PAN)). Note that this field may not always be present. See foreign_id_type |

PersonalField

Example personal field object:

{

"value": "Raj",

"source_ids": ["IND_CHM"],

"unmatched_source_ids": [],

}

An object containing information about the value of the personal field, where it was sourced from, and which sources contained conflicting values for the same field.

| Field | Format | Notes |

|---|---|---|

source_ids* | Array | List of sources which have all reported the same value for the field |

unmatched_source_ids | Array | An optional list of sources which have reported a non-empty value that conflicts with other sources. unmatched_source_ids will only be provided for single fields, and lists of personal fields will not include this property, as an unmatched value will appear in a separate list element. |

value* | Any | The sourced personal field value. Type varies depending on the field |

identities []

Example snippet of identities in the Credit Passport response:

{

"identities": [{

"source_id": "IND_CHM",

"first_name": "Raj",

"last_name": "Du",

"full_name": "Raj Du",

"emails": ["rajdu@email.com"],

"telephones": ["+9146270422"],

"date_of_birth": "1989-10-25",

"is_deceased": false,

"foreign_id": "ADIPA8123J",

"foreign_id_type": "PERMANENT_ACCOUNT_NUMBER",

"documents": [

{

"document_type": "PASSPORT",

"document_number": "A1234567",

"country": "USA",

"issue_date":"2015-05-22",

"expiration_date":"2025-05-22",

},

],

}],

...

}

The applicant's personal identity information reported from each data source. The list of identities is used to calculate the authoritative personal data provided in the Nova Credit Passport®.

| Field | Format | Notes |

|---|---|---|

source_id* | String | The identifier for the source that reported the identity information. See sources |

first_name | String | Applicant's first name |

last_name | String | Applicant's last name |

full_name | String | Applicant's full name |

middle_name | String | Applicant's middle name |

transliterated_full_name | String | Romanization of applicant's full name |

other_names | Array of String | A list of other names associated with applicant, such as aliases, maiden names, and other surnames |

emails | Array of String | Applicant's emails |

telephones | Array of String | Applicant's telephones |

date_of_birth | Full Date | Applicant's date of birth |

year_of_birth | String | Only provided if a full date of birth is not available, but the year is. date_of_birth will be omitted in this case |

is_deceased | Bool | Indicates whether the applicant is deceased. This can only return true for CAN_EFX, MEX_BDC, and MEX_CDC. |

date_of_death | Full Date or Short Date | Only provided if is_deceased is true |

selfie_matched | Bool | true if the selfie matched one of the document pictures, false if not. Only provided if selfie authentication was attempted. |

documents | Array of Objects | A list of documents used to verify the identity, and data from each document |

foreign_id | PersonalField object with String value | The foreign ID provided to us by the consumer. Note that this field may not always be present. |

foreign_id_type | PersonalField object with String value | The type of ID being displayed in capital snake case (e.g., PERMANENT_ACCOUNT_NUMBER, PASSPORT, DRIVERS_LICENSE, etc.). In the PDF this field will appear in plain text (e.g., Permanent Account Number (PAN)). Note that this field may not always be present. |

documents

Example snippet of documents in an identities response:

{

"documents": [{

"document_type": "PASSPORT",

"document_number": "A1234567",

"country": "USA",

"issue_date":"2015-05-22",

"expiration_date":"2025-05-22",

"is_authenticated": true,

}],

}

Objects provided with some identities nodes. Includes properties for documents used to authenticate the applicant.

| Field | Format | Notes |

|---|---|---|

document_type* | String | The document type, for example PASSPORT |

document_number* | String | The identifying number on the document |

country | String | The country of origin of the document |

issue_date | Full Date | The date of issue on the document |

expiration_date | Full Date | The expiration date on the document |

is_authenticated* | Bool | Whether or not the document was judged authentic |

scores []

Example snippet of scores in the Credit Passport response:

{

"scores": [

{

"source_ids": ["IND_CHM"],

"score_type": "NOVA_SCORE_BETA",

"score_version": "1.0.5",

"value": 798,

"risk_indicator": "MEDIUM_RISK",

"history": [

{

"value": 798,

"risk_indicator": "MEDIUM_RISK",

"date_reported": "2019-02-28"

}

...

],

},

{

"source_ids": ["IND_CHM"],

"score_type": "FOREIGN_SCORE",

"value": 992,

"risk_indicator": "LOW_RISK",

"adverse_action_codes": [{

...

}, {

...

}],

"history": [

{

"value": 992,

"risk_indicator": "LOW_RISK",

"date_reported": "2019-02-28",

"adverse_action_codes": [],

},

...

],

}

],

...

}

Information specific to the applicant's credit score, including both the foreign data supplier’s score, as well as the Nova score. scores are returned in an array, and all elements follow the same structure.

| Field | Format | Notes |

|---|---|---|

source_ids* | Array | A list of ids of the sources utilized to generate this score. See sources |

score_type* | String | Type of the score. See score_type |

score_version | Full version | Version of the score type. Only applies if score_type is not FOREIGN_SCORE |

value | Number | Value of the score. |

risk_indicator | String | Risk indicator based on the score. See risk_indicator |

adverse_action_codes | Array | Codes that are either provided directly by the foreign bureau partner or generated by Nova Credit using the consumer credit data provided by the foreign bureau partner, and detail the reasoning behind the score returned. adverse_action_codes are returned in an array, can have zero objects, and there is no upper bound. Not all credit bureaus provide adverse action codes. See adverse_action_codes |

exclusion_codes | Array | Codes that are returned from the foreign bureau and detail a reason why a score wasn't returned. See exclusion_codes |

history | Array | Array of historical scores and associated data See history |

history

A child to scores, history is an array of historical scores and associated data. Score history is not always provided, as it is only reported by some data sources. See supported sources below.

| Field | Format | Notes |

|---|---|---|

date_reported* | Full Date or short date | Date at which historical score object was reported. |

value* | Number | Value of the score. |

score_version | Full version | Only applies if score_type is not FOREIGN_SCORE |

risk_indicator | String | Version of the score type. Risk indicator based on the score. See risk_indicator |

adverse_action_codes | Array | Codes that are either provided directly by the foreign bureau partner or generated by Nova Credit using the consumer credit data provided by the foreign bureau partner, and detail the reasoning behind the score returned. adverse_action_codes are returned in an array, can have zero objects, and there is no upper bound. Not all credit bureaus provide adverse action codes. See adverse_action_codes |

Supported Sources

history | |

|---|---|

| Canada TransUnion (CAN_TU) | ✗ |

| Canada Equifax (CAN_EFX) | ✗ |

| Great Britain Equifax (GBR_EFX) | ✗ |

| India Crif High Mark (IND_CHM) | ✗ |

| India CIBIL (IND_CIBIL) | ✗ |

| Mexico Circulo de Credito (MEX_CDC) | ✗ |

| Mexico Buro de Credito (MEX_BDC) | ✗ |

| Australia Equifax (AUS_EFX) | ✗ |

| Korea NICE (KOR_NICE) | ✓ |

| Nigeria CRC (NGA_CRC) | ✗ |

| Brazil Experian (BRA_XP) | ✗ |

| Kenya Creditinfo (KEN_CI) | ✗ |

| Dominican Republic TransUnion (DOM_TU) | ✗ |

| Philippines CRIF (PHL_CRIF) | ✗ |

| Spain Equifax (ESP_EFX) | ✗ |

| Austria CRIF (AUT_CRIF) | ✗ |

| Germany CRIF (DEU_CRIF) | ✗ |

| Switzerland CRIF (CHE_CRIF) | ✗ |

| Philippines TU (PHL_TU) | ✗ |

| United States Experian (USA_XP) | ✗ |

| Ukraine Creditinfo (UKR_CI) | ✗ |

| South Africa TransUnion (ZAF_TU) | ✓ |

| Ghana XDS Data (GHA_XDS) | ✗ |

| Colombia TransUnion (COL_TU) | ✗ |

adverse_action_codes

Example response from the adverse_action_codes array:

...,

"adverse_action_codes": [{

"code": "T2",

"description": "Many revolving accounts bank national"

},

{

"code": "M0",

"description": "It has a number of accounts currently in default"

},

{

"code": "R1",

"description": "Very few accounts with balances"

}]

}

A child to scores, adverse_action_codes are the codes that are either provided directly by the foreign bureau partner or generated by Nova Credit using the consumer credit data provided by the foreign bureau partner, and detail the reasoning behind the score returned. adverse_action_codes are returned in an array, can have zero objects, and there is no upper bound.

| Field | Format | Notes |

|---|---|---|

code* | String | Adverse action code |

description* | String | Description of the adverse action code |

exclusion_codes

Example response from the exclusion_codes array:

...

"exclusion_codes": [{

"code": "EX02",

"description": "Has no accounts."

}]

}

A child to scores, exclusion_codes are the codes that are returned from the foreign bureau and detail a reason why a score wasn't returned. exclusion_codes are returned in an array, can have zero objects, and there is no upper bound. exclusion_codes will only be returned when a source credit bureau provides such a capacity and a score is not provided by the bureau. They will be attached to a scores object with score_type of FOREIGN_SCORE.

| Field | Format | Notes |

|---|---|---|

code* | String | Exclusion code. See exclusion_codes by bureau |

description* | String | Description of the exclusion code |

metrics []

Example snippet of metrics in the Credit Passport response:

{

"metrics": [

{

"source_ids": ["IND_CHM"],

"metric_status": "AVAILABLE",

"metric_source": "NOVA",

"metric_name": "AGE_TRADELINE_OLDEST",

"metric_value": 32,

"metric_label": "Age of Oldest Tradeline (months)",

"metric_format": "NUMERIC",

"metric_type": "AGE_MONTHS"

},

{

"source_ids": ["IND_CHM"],

"metric_status": "AVAILABLE",

"metric_source": "NOVA",

"metric_name": "RATIO_CREDIT_UTILIZATION_REVOLVING",

"metric_value": 0.40103270223752152,

"metric_label": "Revolving Credit Utilization Ratio",

"metric_format": "NUMERIC",

"metric_type": "RATIO"

},

],

...

}

Metrics are analytical values derived from the underlying data in the Nova Credit Passport®. metrics are returned in an array and are of configurable length; the array can have zero objects, and there is no upper bound.

By default, eight metrics are included in every response:

AGE_TRADELINE_OLDESTCOUNT_INQUIRIES_LAST_6_MONTHSCOUNT_TRADELINES_OPENCOUNT_TRADELINES_PAST_DUE_1_OR_MORE_PAY_CYCLES_LAST_12_MONTHSCOUNT_TRADELINES_PAST_DUE_3_OR_MORE_PAY_CYCLESRATIO_CREDIT_UTILIZATION_REVOLVINGTOTAL_DEBT_ALL_OPENTOTAL_SCHEDULED_PAYMENT_OBLIGATIONS_ALL_OPEN

You can remove these metrics or add additional metrics to your reports by contacting your Nova Credit Representative. Once configured, the ordering and size of the metrics array is consistent across API responses (with the exception of bureau summary data, noted below).

It is possible that you will want to reconfigure these metrics after your initial integration with our API; please consider an approach that permits adding and removing metrics without incurring additional integration work. If you have configured customized metrics, or intend to in the future, please contact your Nova Credit Representative for additional examples, details, and advice. It is particularly important that you discuss the mechanics of your metric integration if it relies on a fixed ordering or maximum number of metrics.

In addition to the metrics included in every report, the foreign bureau may provide additional summary data. In this case, these additional metrics will be prepended to the metrics array and can be differentiated by the value of metric_source.

| Field | Format | Notes |

|---|---|---|

source_ids* | Array | A list of ids of the sources utilized to generate this metric. See sources |

metric_name* | String | Name of the metric. See metric_name |

metric_value | Number/Boolean | Value of the metric. Can be numeric or a boolean value. Only provided if metric_format is NUMERIC or BOOLEAN |

metric_status* | String | Status of the metric. See metric_status |

metric_source* | String | Source of the metric. See metric_source |

metric_label* | String | Human-readable name of the metric. See metric_label |

metric_type* | String | Type of the metric. See metric_type |

metric_format* | String | Format of the metric. See metric_format |

most_recent_date | Full Date or Short Date | Date of first instance in the values array. Only provided if metric_format is TIMESERIES |

metric_timeseries | Object | Timeseries data of the metric. Only provided if metric_format is TIMESERIES. See metric_timeseries |

metric_range | Array | Range of the metric represented as a 2-length numeric array of [lowerbound, upperbound] inclusive range. Only provided if metric_format is RANGE |

metric_timeseries

Object containing values and interval of timeseries data

| Field | Format | Notes |

|---|---|---|

interval* | String | Time interval between metrics in the values array (Timeseries only) See interval |

values* | Array | Array of timeseries data |

currencies []

Example snippet of currencies in the Credit Passport response:

{

"currencies": [{

"original": "INR",

"target": "USD",

"rate": "0.015",

"source": "ECB",

"date": "2017-01-12"

}],

...

}

An array of currencies found in the response and information relating to their conversion.

| Field | Format | Notes |

|---|---|---|

original* | ISO 4217 | The original currency the values were returned in |

target* | ISO 4217 | The currency the original currency was converted to |

rate* | String | The daily rate at which the conversion was made. Can be coerced to float |

source* | String | The source from which the daily rate was obtained. See currency_source |

date* | Full Date or Short Date | The date at which the conversion occurred |

credit_bureaus []

Example snippet of credit_bureaus in the Credit Passport response:

{

"credit_bureaus": [

{

"source_id": "IND_CHM",

"meta": {

...

},

"tradelines": [

...

],

"bank_accounts": [

...

],

"public_records": [

...

],

"frauds": [

...

],

"collections": [

...

],

"nonsufficient_funds": [

...

],

"inquiries": [

...

],

"employers": [

...

],

"addresses": [

...

],

"disputes": [

...

],

"notices": [

...

],

}

...

]

...

}

A list of data sourced from credit bureaus. Each separate entry in the credit bureaus list represents the set of data returned from a single credit bureau response.

| Field | Format | Notes |

|---|---|---|

source_id* | String | An identifier representing this credit bureau data source. See sources |

meta* | Object | Information specific to the credit bureau data that's been returned. See meta |

tradelines | Array | Tradelines refer to the applicant's previous and current credit-related products that they have held in the past seven years. See tradelines |

bank_accounts | Array | Bank accounts refer to the applicant's previous and current bank account products, which they've held over the past seven years. See bank_accounts |

public_records | Array | Public records refer to the applicant's previous and current public records, which they've held over the past seven years. See public_records |

frauds | Array | Frauds refer to the applicant's previous and current fraud reports, which they've held over the past seven years. See frauds |

collections | Array | Collections refer to the third party collections made on the applicant's accounts, which they've held over the past seven years. See collections |

nonsufficient_funds | Array | Nonsufficient funds refer to the nonsufficient fund reports made on the applicant's accounts, which they've held over the past seven years. See nonsufficient_funds |

inquiries | Array | Inquiries are the credit inquiries that have been performed on the applicant's account over the past seven years. See inquiries |

employers | Array | Employers is a history of the applicant’s work experience. See employers |

addresses | Array | Addresses is a history of where the applicant has previously lived. See addresses |

disputes | Array | Disputes refer to the previous and current disputes the applicant has formally made on their credit report. See disputes |

notices | Array | Notices refer to notices and statements provided by the supplying credit bureau or the applicant about the applicant's credit report. See notices |

meta

Example snippet of meta within credit_bureaus:

{

"credit_bureaus": [{

"meta": {

"company_code": "IND_CHM",

"bureau_report_id": "214abi4fop1a4"

},

...

}],

...

}

Information specific to the credit bureau data that's been returned.

| Field | Format | Notes |

|---|---|---|

company_code* | String | Code representing the country & foreign bureau used to pull report See company_code |

bureau_report_id | Deprecated | The unique report identifier for the partner provided report or data. See partner_report_id |

tradelines []

Example snippet of tradelines within credit_bureaus:

{

"credit_bureaus": [{

"tradelines": [{

"tradeline_id": "44dd200a-f404-11e6-bc64-92361f002671",

"institution": null,

"original_currency": "INR",

"date_opened": "2012-12-22",

"date_last_reported": "2017-01-01",

"past_due_balance": 0,

"current_pay_status": "CURRENT",

"scheduled_payment": 500,

"history_frequency": "MONTHLY",

"portfolio_type": "REAL_ESTATE",

"account_type": "MORTGAGE",

"current_condition_type": "TRANSFER_SOLD",

"current_condition_status": "ACTIVE",

"responsibility": "INDIVIDUAL",

"balance": 1104,

"high_balance": 1502,

"credit_limit": 4100,

"payment_obligation_frequency": "MONTHLY",

"history": [{

...

}, {

...

}]

}],

...

}],

...

}

Tradelines refer to the applicant's previous and current credit-related products that they have held in the past seven years. Tradelines are returned in an array, can have zero objects, and there is no upper bound.

| Field | Format | Notes |

|---|---|---|

tradeline_id* | UUID | Reference ID of the tradeline |

institution | String or Null. For compliance reasons, this field will be null except for special cases | Name of the lending institution |

translated_institution | String or Null. For compliance reasons, this field will be null except for special cases | Translated name of the lending institution |

original_currency | ISO 4217 | Currency in which all monetary values in this tradeline were originally provided by the foreign bureau partner |

date_opened | Full Date or Short Date | Date tradeline was opened |

date_last_reported | Full Date or Short Date | Date tradeline was last reported |

date_negative_reported | Full Date or Short Date | Date tradeline reached negative status as indicated by the credit reporting institution |

date_closed | Full Date or Short Date | Date tradeline was closed |

last_payment_amount | Number | Last payment amount |

past_due_balance | Number | Past due balance |

current_pay_status | String | Current pay status. See current_pay_status |

current_pay_substatus | String | Current pay substatus. See current_pay_substatus |

scheduled_payment | Number | Scheduled payment |

history_frequency | String | The frequency of the payments presented in the history field, typically based on the frequency at which the bureau represents the payments. For most cases, the field will be MONTHLY and match with payment_obligation_frequency. However, in the non-standard case of MEX_CDC, there may be a mismatch due to Nova adjusting non-monthly payments to MONTHLY. See history_frequency |

portfolio_type | String | Portfolio type. See portfolio_type |

account_type | String | Account type. See account_type |

current_condition_type | String | Condition the tradeline is in currently. See current_condition_type |

current_condition_status | String | Condition status the tradeline is in currently. See current_condition_status |

responsibility | String | Applicant's responsibility regarding this tradeline. See responsibility |

balance | Number | Balance |

high_balance | Number | High balance |

credit_limit | Number | Credit limit |

is_open | Bool | Indicates whether the tradeline is open |

is_collateralized | Bool | Indicates whether the tradeline is collateralized |

original_loan | Number | Original loan amount |

history | Array | Applicant's tradeline activity. See history |

payment_obligation_frequency | String | Payment obligation frequency. See payment_obligation_frequency |

charge_off_amount | Number | Charge off amount |

comments | Array | Comments from the foreign bureau partner about this tradeline. See comments |

history

Monthly history example over three years:

{

"history": [{

"year": "2016",

"payments": [null, null, null, 1, 1, 1, 0, 0, 0, 0, 0, 0],

"balances": [0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0],

"credit_limits": [710, 710, 710, 710, 710, 710, 710, 710, 710, 710, 710, 700],

}, {

"year": "2015",

"payments": [0, 0, 1, 2, 2, 0, 0, 0, -1, -1, -1, -1],

"balances": [0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0],

"credit_limits": [710, 710, 710, 710, 710, 710, 710, 710, 710, 710, 710, 700],

}]

}

A child to tradelines, history refers to the applicant's tradeline activity. history is returned in an array and can have zero objects or a maximum of 7 objects (one object per year).

The format of history depends on the history_frequency value of the tradeline, which will most often be MONTHLY.

There are multiple histories that the history node reports and are denoted by separate keys in each history object. See the list of supported histories by country at the bottom of the page.

| Field | Description | Format | Notes |

|---|---|---|---|

year* | The year this history object represents | Number | YYYY |

payments* | A history of payments made. Credit accounts only | Array | null = N/A payment, out of range-1 = reported but unknown specifics0 = paid on time1 = Less than or equal to 1 pay period late2 = Less than or equal to 2 pay periods late3 = Less than or equal to 3 pay periods late4 = Less than or equal to 4 pay periods late5 = 5 or more pay periods late |

balances | A history of the tradeline's account balances. Credit and utilities accounts only | Array | null = N/A payment, out of range |

credit_limits | A history of the tradeline's credit limits. Credit accounts only | Array | null = N/A payment, out of range |

history_frequency explanation

| History Frequency | Explanation |

|---|---|

| MONTHLY | Array length equal to 12. The first element is the month of December and the last is January. Nova Credit Credit cannot distinguish where in that month the payment happened, hence Nova Credit defaults to counting from the end of the month onward. |

| BI_MONTHLY (every two months) | Array length equal to 6. The first element is the month of December and the last is January. Nova Credit cannot distinguish where in that month the payment happened, hence Nova Credit defaults to counting from the end of the two months onward. |

| SEMI_MONTHLY (twice in a month) | Array length equal to 24. |

| WEEKLY | Array length equal to 52. The first element is the last week of the year. Nova Credit cannot distinguish where in that month the payment happened, hence Nova Credit defaults to counting from the end of the week. |

| BI_WEEKLY (every two weeks) | Array length equal to 26. |

| QUARTERLY | Array length equal to 4. The first element is the month of December and the last is April. Nova Credit cannot distinguish where in that month the payment happened, hence Nova Credit defaults to counting from the end of the quarter onward. |

| SEMI_ANNUAL | Array length equal to 2. The first element is the month of December and the second element is the month of July. |

| ANNUAL | Array length equal to 1. The first element is the month of December. Nova Credit cannot distinguish where in that year the payment happened, hence Nova Credit defaults to counting from the end of the year onward. |

History Availability

payments | balances | credit_limits | |

|---|---|---|---|

| Canada TransUnion (CAN_TU) | ✓ | ✗ | ✗ |

| Canada Equifax (CAN_EFX) | ✓ | ✗ | ✗ |

| Great Britain Equifax (GBR_EFX) | ✓ | ✓ | ✓ |

| India Crif High Mark (IND_CHM) | ✓ | ✗ | ✗ |

| India CIBIL (IND_CIBIL) | ✓ | ✗ | ✗ |

| Mexico Circulo de Credito (MEX_CDC) | ✓ | ✗ | ✗ |

| Mexico Buro de Credito (MEX_BDC) | ✓ | ✗ | ✗ |

| Australia Equifax (AUS_EFX) | ✓ | ✗ | ✗ |

| Korea NICE (KOR_NICE) | ✗ | ✗ | ✗ |

| Nigeria CRC (NGA_CRC) | ✓ | ✗ | ✗ |

| Brazil Experian (BRA_XP) | ✗ | ✗ | ✗ |

| Kenya Creditinfo (KEN_CI) | ✓ | ✓ | ✗ |

| Dominican Republic TransUnion (DOM_TU) | ✓ | ✗ | ✗ |

| Philippines CRIF (PHL_CRIF) | ✓ | ✗ | ✗ |

| Spain Equifax (ESP_EFX) | ✗ | ✗ | ✗ |

| Austria CRIF (AUT_CRIF) | ✗ | ✗ | ✗ |

| Germany CRIF (DEU_CRIF) | ✗ | ✗ | ✗ |

| Switzerland CRIF (CHE_CRIF) | ✗ | ✗ | ✗ |

| Philippines TU (PHL_TU) | ✓ | ✗ | ✗ |

| United States Experian (USA_XP) | ✓ | ✗ | ✗ |

| Ukraine Creditinfo (UKR_CI) | ✓ | ✗ | ✗ |

| South Africa TransUnion (ZAF_TU) | ✓ | ✗ | ✗ |

| Ghana XDS Data (GHA_XDS) | ✓ | ✗ | ✗ |

| Colombia TransUnion (COL_TU) | ✓ | ✗ | ✗ |

bank_accounts []

Example snippet of bank_accounts within credit_bureaus:

{

"credit_bureaus": [{

"bank_accounts": [{

"bank_account_id": "8c46ab70-d485-11e7-a5ca-95dbcbcedd5b",

"bank_account_type": "CHECKING",

"responsibility": "INDIVIDUAL",

"date_last_reported": "2017-11-01",

"date_opened": "2015-07-19",

"current_pay_status": "CURRENT",

"institution": null,

"is_overdraftable": false,

"is_overdrawn": false,

"balance": 20048,

"original_currency": "GBP",

"comments": [ ... ]

}],

...

}],

...

}

Bank accounts refer to the applicant's previous and current bank account products, which they've held over the past seven years. Bank accounts are returned in an array, can have zero objects, and there is no upper bound.

| Field | Format | Notes |

|---|---|---|

bank_account_id* | UUID | Reference ID of the bank account |

bank_account_type* | String | Bank account type. See bank_account_type |

date_last_reported* | Full Date or Short Date | Date bank account was last reported |

date_opened | Full Date or Short Date | Date bank account was opened |

date_closed | Full Date or Short Date | Date bank account was closed |

current_pay_status | String | When no overdraft has ever occurred on the bank account, this field can be blank. See current_pay_status |

current_pay_substatus | String | When no overdraft has ever occurred on the bank account, this field can be blank. See current_pay_substatus |

institution | String or Null. For compliance reasons, this field will be null except for special cases | Name of the institution providing the account |

translated_institution | String or Null. For compliance reasons, this field will be null except for special cases | Translated name of the institution providing the account |

is_overdraftable | Bool | Indicates whether the bank account has an overdraft facility |

is_overdrawn* | Bool | Indicates whether an overdraft event occurred in the past |

responsibility | String | Applicant's responsibility regarding this bank account. See responsibility |

balance | Number | Balance |

original_currency* | ISO 4217 | Currency in which all monetary values in this bank account were originally provided by the foreign bureau partner |

comments | Array | Comments from the foreign bureau partner about this bank account. See comments |

Supported Bureaus

bank_accounts | |

|---|---|

| Canada TransUnion (CAN_TU) | ✓ |

| Canada Equifax (CAN_EFX) | ✓ |

| Great Britain Equifax (GBR_EFX) | ✓ |

| India Crif High Mark (IND_CHM) | ✗ |

| India CIBIL (IND_CIBIL) | ✗ |

| Mexico Circulo de Credito (MEX_CDC) | ✗ |

| Mexico Buro de Credito (MEX_BDC) | ✗ |

| Australia Equifax (AUS_EFX) | ✗ |

| Korea NICE (KOR_NICE) | ✓ |

| Nigeria CRC (NGA_CRC) | ✗ |

| Brazil Experian (BRA_XP) | ✗ |

| Kenya Creditinfo (KEN_CI) | ✗ |

| Dominican Republic TransUnion (DOM_TU) | ✗ |

| Philippines CRIF (PHL_CRIF) | ✗ |

| Spain Equifax (ESP_EFX) | ✗ |

| Austria CRIF (AUT_CRIF) | ✗ |

| Germany CRIF (DEU_CRIF) | ✗ |

| Switzerland CRIF (CHE_CRIF) | ✗ |

| Philippines TU (PHL_TU) | ✗ |

| United States Experian (USA_XP) | ✗ |

| Ukraine Creditinfo (UKR_CI) | ✗ |

| South Africa TransUnion (ZAF_TU) | ✗ |

| Ghana XDS Data (GHA_XDS) | ✗ |

| Colombia TransUnion (COL_TU) | ✓ |

public_records []

Example snippet of public_records within credit_bureaus:

{

"credit_bureaus": [{

"public_records": [{

"public_record_id": "8c463646-d485-11e7-a5ca-95dbcbcedd5b",

"public_record_type": "FORECLOSURE",

"is_resolved": true,

"date_filed": "2014-06-01",

"court_name": "ABERDARE",

"date_last_reported": "2014-08-01",

"comments": [ ... ],

}],

...

}],

...

}

Public records refer to the applicant's previous and current public records, which they've held over the past seven years. public_records are returned in an array, can have zero objects, and there is no upper bound.

| Field | Format | Notes |

|---|---|---|

public_record_id* | UUID | Reference ID of the public record |

public_record_type | String | Public record type. See public_record_type |

is_resolved | Bool | Indicates whether the public record has been resolved |

date_filed | Full Date or Short Date | Date public record was filed |

court_name | String | Court name |

date_last_reported | Full Date or Short Date | Date public record was last reported |

comments | Array | Comments from the foreign bureau partner about this public record. See comments |

Supported Bureaus

public_records | |

|---|---|

| Canada TransUnion (CAN_TU) | ✓ |

| Canada Equifax (CAN_EFX) | ✓ |

| Great Britain Equifax (GBR_EFX) | ✓ |

| India Crif High Mark (IND_CHM) | ✗ |

| India CIBIL (IND_CIBIL) | ✗ |

| Mexico Circulo de Credito (MEX_CDC) | ✗ |

| Mexico Buro de Credito (MEX_BDC) | ✗ |

| Australia Equifax (AUS_EFX) | ✓ |

| Korea NICE (KOR_NICE) | ✓ |

| Nigeria CRC (NGA_CRC) | ✗ |

| Brazil Experian (BRA_XP) | ✓ |

| Kenya Creditinfo (KEN_CI) | ✗ |

| Dominican Republic TransUnion (DOM_TU) | ✗ |

| Philippines CRIF (PHL_CRIF) | ✗ |

| Spain Equifax (ESP_EFX) | ✗ |

| Austria CRIF (AUT_CRIF) | ✓ |

| Germany CRIF (DEU_CRIF) | ✓ |

| Switzerland CRIF (CHE_CRIF) | ✓ |

| Philippines TU (PHL_TU) | ✗ |

| United States Experian (USA_XP) | ✓ |

| Ukraine Creditinfo (UKR_CI) | ✗ |

| South Africa TransUnion (ZAF_TU) | ✓ |

| Ghana XDS Data (GHA_XDS) | ✓ |

| Colombia TransUnion (COL_TU) | ✓ |

frauds []

Example snippet of frauds within credit_bureaus:

{

"credit_bureaus": [{

"frauds": [{

"fraud_id": "40b1ccae-92c2-4daa-9dbe-d6c82119542a",

"date_reported": "2016-12-12",

"is_fraudster": false,

"comments": [ ... ],

"linked_entries": {

"tradeline_id": "a521d723-0362-4e15-84eb-a7574dd730d6",

},

}],

...

}],

...

}

Frauds refer to the applicant's previous and current fraud reports, which they've held over the past seven years. Frauds are returned in an array, can have zero objects, and there is no upper bound.

The data provided in the frauds node is returned unaltered from the supplying credit bureau. To see a complete list of potential values returned for frauds, please contact your Nova Credit Representative.

| Field | Format | Notes |

|---|---|---|

fraud_id* | UUID | Reference ID of the fraud |

date_reported | Full date | Date fraud was reported |

is_fraudster* | Bool | true if the consumer is the perpetrator of the fraud, false if the consumer is the victim of the fraud |

comments | Array | Comments from the foreign bureau partner about this fraud. See comments |

linked_entries | Object | Entries linked to this fraud. See linked_entries |

Supported Bureaus

frauds | |

|---|---|

| Canada TransUnion (CAN_TU) | ✓ |

| Canada Equifax (CAN_EFX) | ✓ |

| Great Britain Equifax (GBR_EFX) | ✗ |

| India Crif High Mark (IND_CHM) | ✗ |

| India CIBIL (IND_CIBIL) | ✗ |

| Mexico Circulo de Credito (MEX_CDC) | ✓ |

| Mexico Buro de Credito (MEX_BDC) | ✓ |

| Australia Equifax (AUS_EFX) | ✗ |

| Korea NICE (KOR_NICE) | ✓ |

| Nigeria CRC (NGA_CRC) | ✗ |

| Brazil Experian (BRA_XP) | ✗ |

| Kenya Creditinfo (KEN_CI) | ✓ |

| Dominican Republic TransUnion (DOM_TU) | ✓ |

| Philippines CRIF (PHL_CRIF) | ✓ |

| Spain Equifax (ESP_EFX) | ✗ |

| Austria CRIF (AUT_CRIF) | ✗ |

| Germany CRIF (DEU_CRIF) | ✗ |

| Switzerland CRIF (CHE_CRIF) | ✗ |

| Philippines TU (PHL_TU) | ✓ |

| United States Experian (USA_XP) | ✗ |

| Ukraine Creditinfo (UKR_CI) | ✓ |

| South Africa TransUnion (ZAF_TU) | ✗ |

| Ghana XDS Data (GHA_XDS) | ✗ |

| Colombia TransUnion (COL_TU) | ✓ |

collections []

Example snippet of collections within credit_bureaus:

{

"credit_bureaus": [{

"collections": [{

"collection_id": "b74180a7-c2a8-496c-9b93-1a8ed9d4f818",

"is_paid": true,

"agency_name": "METRO RECOVERY",

"date_last_reported": "2015-11-01",

"balance": 176,

"date_filed": "2016-07-01",

"date_last_payment": "2015-11-01",

"original_currency": "CAD",

"comments": [ ... ],

"linked_entries": {

"tradeline_id": "13fc76b4-5bb9-48ac-8376-ec3e2407c206",

},

}],

...

}],

...

}

Collections refer to the third party collections made on the applicant's accounts, which they've held over the past seven years. collections are returned in an array, can have zero objects, and there is no upper bound.

| Field | Format | Notes |

|---|---|---|

collection_id* | UUID | Reference ID of the collection |

is_paid* | Bool | Indicates whether the collection has been paid off |

agency_name | String | Collection agency name |

date_last_reported | Full Date or Short Date | Date collection was last reported |

balance* | Number | Amount still owed to agency |

date_filed | Full Date or Short Date | Date collection was given to collection agency |

date_last_payment | Full Date or Short Date | Date of last payment |

original_currency* | ISO 4217 | Currency in which all monetary values in this collection were originally provided by the foreign bureau partner |

statement | String | Full description of the collection |

comments | Array | Comments from the foreign bureau partner about this collection. See comments |

linked_entries | Object | Entries linked to this collection. See linked_entries |

Supported Bureaus

collections | |

|---|---|

| Canada TransUnion (CAN_TU) | ✓ |